Today’s column continues my select report on the IDB Note, ‘Traversing a Slippery Slope: Guyana’s Oil Opportunity.’ As noted, I focus on two areas of the Note. First, its treatment of the fiscal mechanism was embedded in the emerging hydrocarbons sector, and, second, its modeling and measurement of the Government of Guyana Government (revenue). Today’s column begins with a brief wrap of the IDB’s reports on the fiscal mechanism, which I had presented in the column last week. After that, I will begin to address the IDB’s reports on its modeling and measurement of the Government of Guyana’s (GoG) Take (revenue).

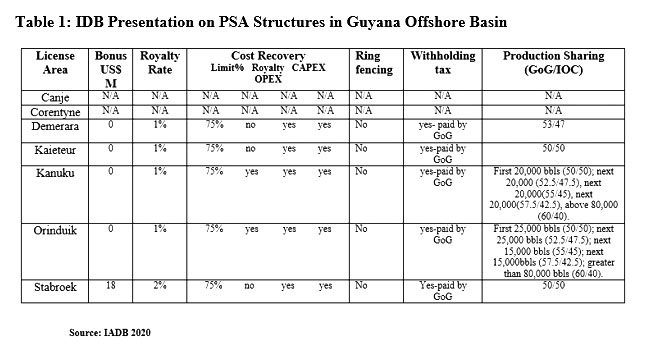

For the convenience of readers only, Table 1 above is reproduced in its entirety from the IDB Note (page 13). This table neatly summarizes several key data on Guyana PSAs that were available to the IDB at the time. The data reveal that there are seven licensed districts in Guyana in the order listed here; namely, Canje, Corentyne, Demerara, Kaiteur, Kanuku, Orinduk and Stabroek. Similarly, the table reports seven structures; namely, licensed areas, bonuses, royalties, cost recovery, fencing, tax withholding, and production sharing. No information is reported to the IDB for the first two licensed areas, Canje and Corentyne.

Further, only the Stabroek has a signature bonus. While the royalty rate is 2 percent for Stabroek, it is one percent for the other four information districts. However, cost recovery is set at a maximum of 75 per cent for the five licensed areas with available information. To be sure, cost recovery applies to both capital and operating expenditure. There are no fences and the Government pays the contractor withholding tax out of profit oil / gas.

Finally, the production split between the government and the contractor reveals some discrimination. The first two listed license areas have no information available. Stabroek and Kaiteur are 50/50 while Demerara is 53/47. Kanuku and Orinduk use a sliding scale that is positively related to the daily production rate (DROP).

Table 1: IDB Presentation on PSA Structures in Guyana Offshore Basin Modeling

In this section, I begin to report on the IDB’s modeling and estimation of the Guyana government’s likely share of total oil revenues. I begin by carefully specifying the assumptions of the model as these ultimately determine the validity of the results. In what follows, I list five key assumptions identified in the Note and present them in the given order.

Assumptions

As a background the Note states that the existing licensed areas from which they will extrapolate in the future have been allocated through bilateral negotiations between the government and the contractor. Further, these areas are at various stages of exploration, drilling, development and production. ExxonMobil with partners, located on the Stabroek Block, is currently the only production contractor from which to extrapolate production profiles.

Based on this profile, the first assumption is to structure the model around the five Stabroek commissioned projects and their targeted combined output of 750,000 barrels of oil equivalent (boe) per day. This is based on an estimated Stabroek field recoverable resource of 8+ billion boe, obtained from 16 discoveries to date.

The second assumption is to exclude natural gas from the model. This is achieved by allocating the gas to improve the recovery of crude oil as well as conserving it for yet-to-be determined gas-on-shore activities. Third, the production life of each project is assumed to be 20 years. And the decommissioning period for each project is two years.

Fourth, the assumed structure and sequence of projects up to 2025 are as follows: phase 1 Liza continues to generate @ 120,000 boe / day; Liza phase 2, starting in 2022 producing @ 220,000 boe / day; Payara starts 2023 producing @ 220,000 boe per day; Project 4 starts 2024 producing a profile similar to Liza 1 and Project 5 also producing a similar profile to Liza 1. The five projects together produce 750,000 boe per day.

Fifth, all five projects are assumed to immediately increase to their full production capacity and plateau in year 1 of their 20-year life. This is clearly a heroic assumption used for mathematical convenience. Furthermore, the average decay rate for Liza 1 and projects 4 and 5 after a plateau is 0.62%. And, for Liza 2 and Payara it’s 1.71%.

Assumptions on cost details, (such as capital and operating expenditure) as well as future prices will be set out in an upcoming column where I note the IDB’s use of the IMF’s Resource Industries Fiscal Analysis (FARI) model, which has been considered for some time back in this column.

Collection

The space left in today’s column is not sufficient for me to conveniently present a simple timetable that summarizes the progression of the five projects described above. I will present this timetable and set out the model parameters next week before addressing its results.