Extract from a petition sent to the UN General Assembly

Last Wednesday, Transparency International (TI) presented a petition, signed by more than 700 organizations and individuals from 120 countries, calling on the UN General Assembly Special Session on Corruption (UNGASS 2021) to end, once and in perpetuity, to the abuse by anonymous companies and other legal vehicles that facilitate cross-border corruption and other crimes. According to the petitioners, these companies, which only exist on paper, exploit countries’ legal systems and conceal their ultimate ownership, leading to the diverting of critical resources needed to promote sustainable development and collective security . Accordingly, they call for central public beneficial ownership registers as a world-class standard.

In our article of 14 December 2020, we noted that TI identified three key issues that UNGASS 2021 urgently needs to address. Apart from the call for transparency in the ownership of companies, TI noted that national justice systems are often unable or unwilling to hold the powerful to account. In such a situation, high-level corrupt officials have the upper hand and act impatiently. In addition, it is not enough to prosecute those who have been involved in corrupt behavior. The stolen assets must be recovered for the benefit of the stolen community.

On Friday, 12 February 2021, the Minister responsible for Revenue estimates Revenue and Expenditure to the National Assembly for the financial year 2021. Last week, the general debate on the Estimates began, and it is expected that the Assembly will resolves itself today to the Delivery Committee to consider and approve the proposed allocations for the programs and activities of Ministries / Departments / Regions as well as subsidies and contributions to the wider public sector entities.

Last week, we began an examination of the performance of the economy in 2020 as contained in the Minister’s budget speech. The most important aspects are as follows:

Real GDP growth totaled 43.5 percent. However, non-oil growth fell by 7.3 percent;

Inflation remained low at 0.9 percent;

The interest rate on small savings was 0.91 percent while the lending rate was 8.96 percent;

Total revenue was G $ 227.4 billion while total expenditure was G $ 325.5 billion, including capital expenditure of G $ 76.1 million;

The fiscal deficit was G $ 90.5 billion, or 9.4 percent of GDP;

The balance of payments account reflected a surplus of US $ 60.6 million, compared to a deficit of US $ 48.9 million in 2019;

The current account deficit was reduced from US $ 1.803 billion to US $ 651.7 million;

The capital account surplus was reduced from US $ 1.766 billion to US $ 720.9 million;

Gross international reserve was U $ 680.6 million, representing two months of imports;

Total public debt (including publicly overdrawn and Consolidated Fund overdraft) was US $ 2.592 billion, representing a debt-to-GDP ratio of 47.4 percent; a

The exchange rate remained stable at G $ 208.5 = US $ 1.

Public Debt

We had noted that the amount of US $ 2.592 billion representing the total public debt at the end of 2020, appeared to be understated compared to the reported public debt at the end of 2019. Now that Estimates for 2021 on the Ministry of Finance website, provided the analysis of US $ 2.592 billion, as summarized in Table I, with comparative

figures for the previous two years as well as projections at the end of 2021:

Despite this policy, in 2018 and 2019, the profits from these medium-term Treasury Bills (182 and 364 days) were deposited into the Consolidated Fund, thereby reducing the overdraft on the Consolidated Fund at the end of 2019 of estimated of G $ 213.006 billion. to $ G124.288 billion. Had the stated accounting policy been followed, the overdraft at the end of 2020 would have been approximately G $ 289.9 billion, equivalent to US $ 1.386 million, instead of US $ 785 million shown in the table above. This clarifies our concern about the understatement of total public debt as reflected in the Estimates.

The Ministry argued that the Minister was empowered under the Financial Management Accountability Act (FMA) to seek funding through borrowing to reduce the overdraft on the Consolidated Fund; and the issue is more related to bridging a fiscal gap and has no relation to monetary policy that falls within the remit of the Bank of Guyana. The Ministry referred to Section 61 which states that the proceeds of any such borrowing by the Government will be paid into the Consolidated Fund.

However, the Ministry ignored the fact that, while Section 60 allows the Minister to approve the use of overdraft advances in an official bank account to meet shortfalls in meeting the annual budget, all such advances must be repaid before the end of the financial year. Apart from the Ministry’s assertion, apart from the Ministry’s assertion, the issue of medium-term Treasury Bills is more about monetary policy of liquidity mopping, not funding of budget deficits, hence the rationale for creating ‘ r Financial Sterilization Account. .

It would seem necessary to revisit the issue of Treasury Bills, either short term (91 days) or medium term (182 and 364 days), in the light of the requirements of the FMA Act. There is also a need to revisit the continued use of the Financial Sterilization Account as a means of populating liquidity and keeping inflation in mind. Indeed, the continued use of Treasury Bills (as Bills mature and are redeemed, New Bills Announced) as well as access to overdraft facilities provided at Guyana Bank, provide the Government with every incentive to replace deficit budgets balanced. At some point, the bubble is likely to burst, and only oil revenue can save us the day. For the period 2014 to 2020, the total fiscal deficit was G $ 247.887 billion, giving an annual average of G $ 35.412 billion. The projected deficit for 2021 is G $ 106.7 billion

Targets for 2021

The economy is expected to grow 20.9 percent, compared with 43.5 percent in 2020. However, non-oil growth is forecast to be 6.1 percent, compared with a decline of 7.3 percent in 2020. The hypothesis is that the economy will reopen and the COVID -19 pandemic restrictions will gradually be lifted. The inflation target rate is 1.6 percent.

The overall balance of payments is expected to reflect a positive balance of US $ 59.9 million, slightly lower than recorded in 2020. The current account balance is forecast to move a deficit of US $ 651.7 million to a surplus of US $ 65.7 million due to higher export mainly anticipated. earnings. The capital account balance, however, is expected to reflect a deficit of US $ 5.8 million, compared to a surplus of US $ 720.9 million in 2020. This is due to higher projected outflows from private enterprises compared to projected inflows of foreign investments.

Current revenue is expected to be G $ 257.9 billion, compared to G $ 227.4 billion in 2020, a 13.4 percent increase. Total anticipated expenditure is G $ 366.9 billion, including capital expenditure of G $ 103.2 billion. In 2020, the actual expenditure was G $ 325.5 billion. Therefore, the planned spending increase is G $ 41.4 billion or 12.7 percent. The overall fiscal deficit is forecast to be 8.7 per cent of GDP. The actual budget size, including interest payments as well as expenditure which is a direct charge on the Consolidated Fund, is G $ 383.1 billion.

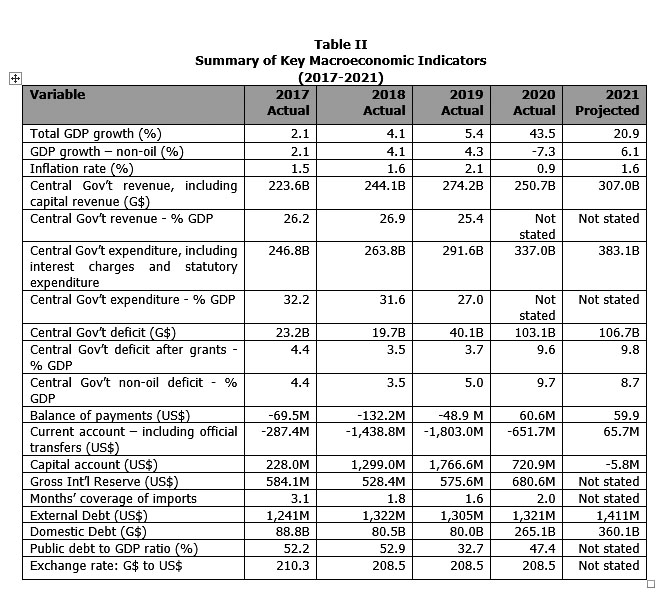

Table II provides a summary of the key macroeconomic indicators for 2020, together with comparative figures for the previous three years as well as projections for 2021:

Budget measures for 2021

(a) The Minister announced the budgetary measures:

(b) zero-rate VAT on basic food items and household necessities;

(c) Five per cent reduction in overall water tariffs;

(d) zero-rate VAT on building materials;

Five per cent reduction in VAT for industrial grade cement;

(e) Ceiling increase from $ 10 million to $ 12 million in respect of loans from commercial banks for housing;

(f) Ceiling increase to $ 15 million in respect of loans from the New Building

Housing association;

(g) To incur VAT on ICT services for residential and individual use;

(h) VAT deduction on ATVs for hinterland use;

(i) Introduce cash grants of $ 15,000 per child attending nursery, primary and

secondary schools in the public school system;

(g) Increase in old age pension from $ 20,500 to $ 25,000 per month;

(k) An increase in public support payments from $ 9,000 to $ 12,000 per month;

(h) Exemption from capital gains tax for the disposal of property over 25; a

(m) zero-rate VAT on imported goods / services and work by budget agencies.