In today’s column I continue my brief evaluation of the adverse effects of the general 2020 crisis, as I have defined this phenomenon, on Guyana’s baby oil and gas sector. So far, I have dealt with the adverse effects on the price and volume of sales of Guyana crude oil. To recall, the new oil sector was modeled and announced by the Authorities in Q4, 2019 with a 2020 output of 102,000 barrels of crude oil per day and a price of US 64 per barrel. By then the main contractor, ExxonMobil and its partners, had already projected output at 120,000 barrels per day.

Based on calculations of the Government of Guyana’s (GoG) projected 2020 profit share provided by the Department of Energy (DoE) – five million barrels of crude oil against the reported profit share of just four million barrels – there is an indication of a shortfall output in the region of 20%. Similarly, based on projected royalties calculations – US $ 18 million for 2020 – the 2% rate on gross production would produce a gross value of US $ 0.9 billion for 2020. Both these calculations are rough ok. However, they do remind us of the gap in the provision of timely data on sector performance by both public and private authorities.

The valuations given in the paragraph above reflect combined price and quantity effects. With all Guyana sales taking place in the world market, the prices received are available in real time. I remain convinced that the significant decline in global crude oil prices is reflected in the delay in announcing Guyana oil sales.

Performance barrier

Four factors were highlighted last week as largely responsible for the 2020 production delay identified in Guyana. First, initial mechanical problems (associated with compression); second, an inability to make timely repairs and maintenance due to pandemic-related obstructions and delays; third, pandemic-related considerations also hindered the deployment of foreign and local workers to Guyana’s offshore production facilities; and fourth, regulatory holdings, particularly in respect of permissions for the Payara project, are progressing. The latter was also affected by the electoral and political crisis following national elections.

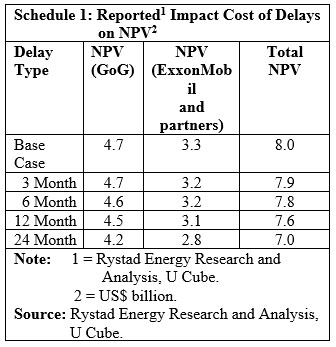

Indeed, such considerations led Rystad Energy to publish a report on the “costs of the impact of delays” in implementing planned production in Guyana’s baby oil and gas sector. I had evaluated this report in my September, 27 2020 column; and I reproduce in Schedule 1 data showing Rystad’s results. The Schedule clearly reveals a clear result; that is, the net present value (NPV), generated by available projects declines as the time period of the delay increases. It is clear that delays are likely to be incrementally expensive.

As a parent, it is worth noting that the reported shares of NPV going to GoG and the contractor (ExxonMobil and its partners) in the Rystad Energy report confirm that their separate estimate of GoG takes 60 %.

Measuring Effects

To the average reader, the list of micro and macroeconomic effects of the 2020 crisis that should be investigated and quantified is quite overwhelming. Therefore, in earlier columns, I tried to find a proxy / summary indicator that best captured the totality of these economic impacts for the benefit of the general public. That proxy indicator or measure is the GDP at constant prices.

I have developed the proposition that Guyana’s GDP growth rate at constant prices is a succinct measure of both positive and negative economic impacts. As a result, I have used time-based differences in Guyana’s estimated GDP growth rates, starting with the Authorities’ pre-crisis estimates and subsequent ones as the crisis unfolded during 2020, as a measure of overall economic value the reversals or obstacles. to the economy. Although the estimates provided by the organization vary, all downward estimates were reviewed later in the year in which they were made.

Readers should observe that the World Bank’s World Economic Forecasting (WEO) provides a simple and effective description of what the GDP represents. As the WEO states: “this is the single most widely used measure of the overall economic activity of a country (Guyana). It represents the total value of end goods and services at constant prices produced in a country (Guyana) during a given period of time (2020) ”. Thus the performance of Guyana’s oil and gas sector is captured in its GDP measurements. As a result, as estimates of this measure are updated as 2020 progresses, these estimates should capture the economic effects of the general 2020 crisis on the hydrocarbons sector in Guyana’s GDP performance.

Updated forecasts reveal quite dramatic results. The original 2020 forecast made by the Authorities back in Q4, 2019 was based on an expectation that:

1) continued investment in the oil and gas sector in 2020;

2) an average output of 102,000 barrels of oil per day;

3) oil sold at US $ 64 per barrel.

This forecast was made jointly by the Guyana Authorities and the IMF and published in Q4, 2019. It revealed a projected growth rate of 86% for 2020. This rate was easily the fastest growth rate predicted for any country in the world, for 2020!

Collection

Next week, I will present a Schedule summarizing these data as I wrap this presentation on using real GDP behavior as a proxy indicator for the economic effects of the 2020 general crisis on Guyana’s baby oil and gas sector.