The current balance projects a surplus of $ 2,609 million, a reversal of $ 23,046 million over revised 2020. Current revenue of $ 266,023 million represents a $ 38,918 million 17.1% increase over the most recent 2020 estimate of $ 227,411 million.

Current budgeted expenditure is $ 256,685.3 million, an increase of $ 15,090 million (6.2%) while Interest Expenditure is budgeted at $ 6,729 million, an increase of $ 485 million 7.8% giving a Current Balance of $ 2,609 million ‘compared to the latest estimates for 2020 of ($ 20,437) million. .

Finance and Capital Grants are budgeted at $ 10,406 million compared to $ 7,562 million for 2020. Budgeted Capital Expenditure is $ 103,248 million which is approximately $ 27,133 million over 2020. After Debt Repayment o

$ 16,419 million, projected an overall deficit of $ 106,652 million, compared to a deficit of $ 103,004 million in 2020, 29% of which is expected to be financed by loans from external sources and 71% from domestic sources. Of current expenditure, personal earnings account for approximately 33%. Debt service as a percentage of current revenue is projected to be 8.7% in 2021, an increase of 8.5% in 2020.

The key elements of the 2021 Plan are:

Total current revenue is projected to increase $ 38,918 million to $ 266,023 million or 17.1%. Of this, the Guyana Finance Authority is expected to account for revenue of $ 242,091 million or 91% of total revenue, an increase of $ 23,761 million or 10.9% compared to 2019 but the latest normal year the increase is 7%. About half of this increase is projected to come from ‘Other’ which includes rent, royalties, dividends, transfers, etc.

2021 will see the deficit expand from $ 103,004 million to $ 106,652 million.

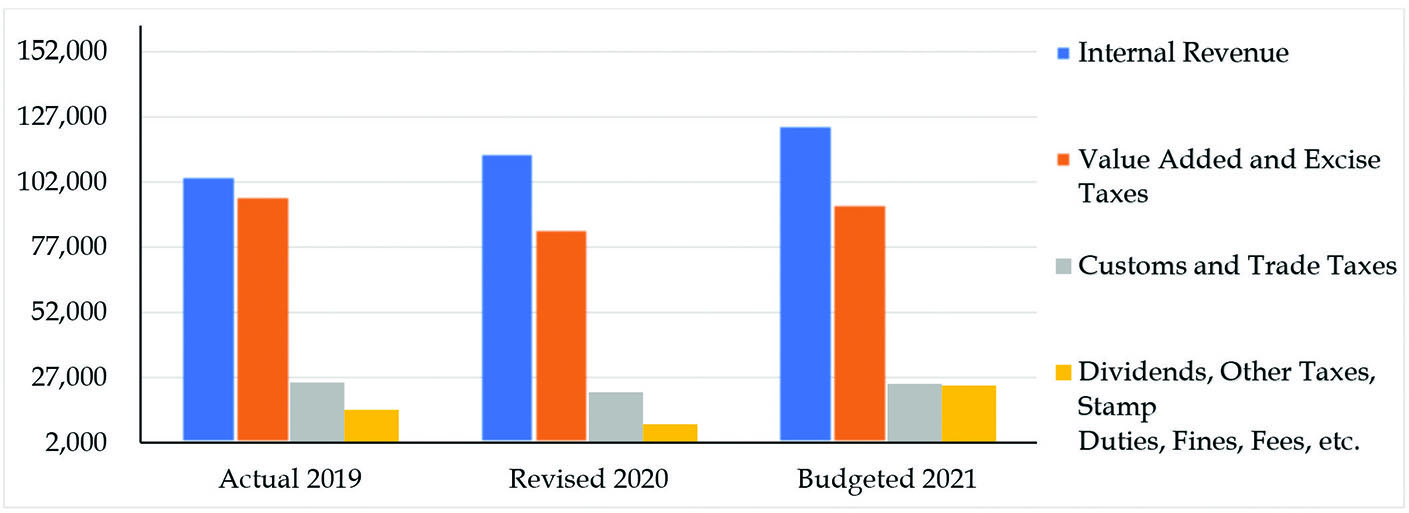

Source: National Estimates (G $ Millions)

From the GRA conclusions, Internal Revenue is projected to account for $ 123,757 million compared to $ 113,161 million in 2020, a 9.4% increase, while Value Added and Home Tax is expected to earn $ 93,701 million compared to $ 83,830 million in 2020, an 11.7% increase. Collections by the Ministry of Customs and Commerce are projected at $ 24,633 million, an increase of $ 3,293 million or 16%.

An examination of revenue projections for the full year of 2021 shows that Company Tax increases by 7.62%, Personal Tax 9.24% and Self-Employed 12.17%.

Despite the proposed changes in VAT legislation, overall VAT collections are projected to increase by 7.6%, with VAT on Imports expected to increase by a higher percentage than domestic supplies.

Customs Tax payable mainly on vehicles, alcohol and tobacco is projected to increase by 18% with a significant proportion of the increase being generated from imports. Other current revenue is expected to double across revenue sources including variable.

Total current interest-free spending is projected to increase $ 15,090 million from $ 241,595 million in 2020 to $ 256,685 million for 2021. Personal earnings of $ 79,563 million represent an increase of 10.7% or $ 7,711 million over the revised figures for 2020. As a percentage of currents interest-free spending, personnel earnings account for 31%, Other Goods and Services 27% and Transfer Payments 41%.

Transfer payments are Government payments to individuals, organizations or other levels of Government made with the express purpose of promoting the delivery of Government policy or programs and for which the Government does not receive any goods or services directly .

Capital expenditure of $ 103,248 million represents a projected increase of $ 27,133 million or 35.6% over revised 2020 of $ 76,115 million. The top five ministers for capital expenditure are:

1. Ministry of Public Works

2. Ministry of Finance

3. Ministry of Housing and Water

4. Ministry of Agriculture

5. Office of the Prime Minister

Interest expenditures are projected to increase 7.8% or $ 485 million to $ 6,729 million. Domestic interest is projected to increase $ 274.9 million or 20.8%, while interest on external debt is projected to increase $ 789.9 million or 16%.

The principal component of debt repayments is projected to be $ 16,419 million (2020: $ 13,080 million), which includes domestic debt repayments of $ 3,800 million anticipated (2020: $ 2,040 million), while debt repayments are forecast. External debt holdings increase to $ 1,579 million (2020: $ 11,040 million).

Ram and McRae comments

● When the country first recorded its $ 100 billion budget in 2010 there was much praise, but since that year, the pattern of rising deficits has defined all budgets. In 2020 and 2021, the deficits are (40.1%) and (45.4%) of current revenue.

● Prior to Budget, the Government introduced legislation increasing the domestic and external debt ceiling. Hopefully, with more oil revenue, the pattern will be reversed and Guyana will become a net investor of funds.

● The 2020 Estimates (Capital Expenditure Details) Budget 2020 focus highlighted $ 267.4 million of spending by this previous administration on a range of issues including a gas-fired study. It would be a sad and costly waste if such a study were to be completely ignored.

● A review of the revenue projections in Volume 1 of the Estimates does not identify profit oil and petroleum royalties, possibly due to the restriction imposed by the Natural Repayment Act which has not yet been implemented. More troublingly, Medium Term Central Government Table 1 itself does not show any line item for Oil Revenue. Whether this omission was due to uncertainty about how to handle the revenue, for some other reason, it is strange that we are taking oil forward in a paid / limited analytics balance or not.

● In announcing the budgetary measures, the Minister claimed that the annual cost of measures announced in Budget 2020 was over $ 40 billion and that the additional measures for 2021 will cost an additional $ 10 billion, making a total of $ 50 billion. Despite this, the Minister is forecasting a 17% higher revenue that is difficult to reconcile with the $ 50 billion.