Today’s column recaptures the details, which informs my strong bullish outlook on Guyana’s world-class hydrocarbons potential. Although it does not fall within the scope of this column, I take the opportunity to remind readers that I have a very strong outlook on Guyana’s broader energy potential, not just oil and gas. As said last week, two lines of reasoning inform my view; namely, the Atlantic Mirror Image theory and two published USGS Geological Service assessments of the Guyana-Suriname Basin hydrocarbon resource potential. Details of these are retrieved below.

Atlantic Mirror Image Theory

The literature reveals that more and more geoscientists have held the view that Guyana’s oil and gas discoveries reveal the result of drift apart from what was originally a unified global super-continent, merging South America and Africa. This separation has obviously happened over and over, in layman’s terms which I refer to as geological time. It also led to the formation of the Equatorial Guianas Margin (covering both offshore and inland portions of Guyana, Suriname, French Guiana, as well as restricted portions of Venezuela and Brazil). From my reading of the literature, it seems to suggest that the petroleum geology of the Guianas area is very similar to the geography of West Africa. And, it includes two sedimentary basins, the Guyana-Suriname Basin and the Foz do Amazonas Basin. As I had reported earlier, the Equatorial Guianas / Guianas Basin is separated by the Demerara Plateau, which is a dense, high succession of Jurassic and Cretaceous-carbonate-rich sediments.

The circumstances described above give rise to the thesis and my layman’s reasoning that the Guianas Basin petroleum system is a “mirror image” of the West African petroleum system. In the latter, several major hydrocarbon concentrations have recently been discovered, including the famous Jubilee discovery, offshore Ghana.

USGS assessment

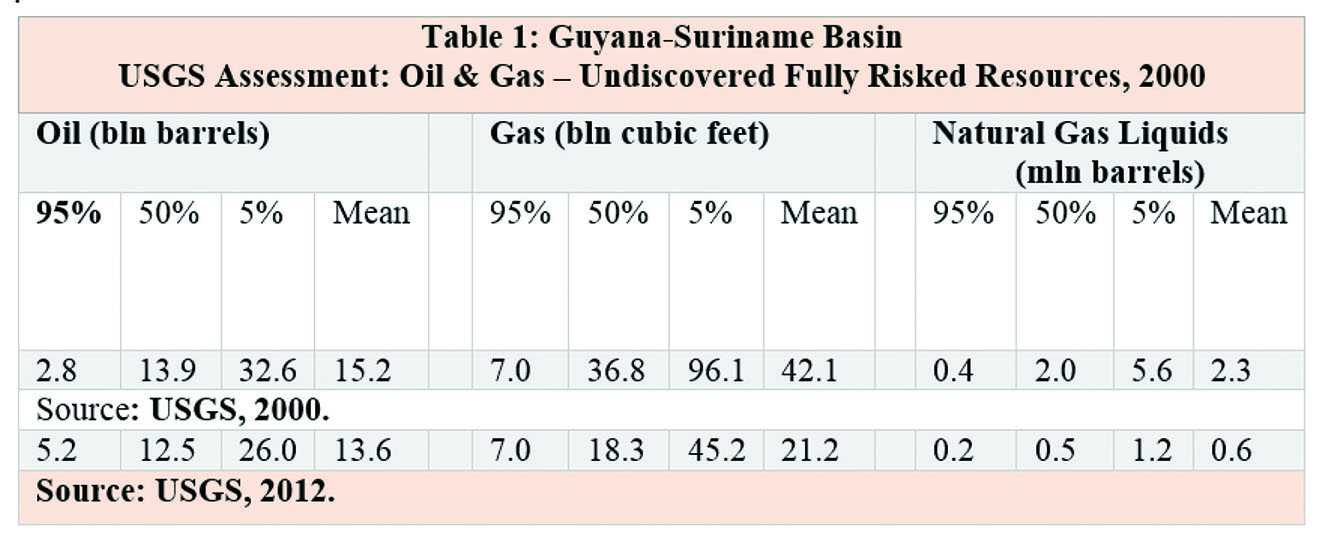

Turning to the second line of reasoning, I rely on two USGS Fact Sheets presenting summaries of data collected from two World Energy Assessments it conducted on Oil and Gas Undiscovered Resources for Mid and South America as well as the Caribbean region (2000 and 2012). As I’ve always been in pains to point out, USGS information is provided “at full risk”. The estimates are provided at 95%, 50% and 5% probability levels. Further, the mean probability is also reported (where fractures are additive, assuming perfect positive correlation).

Estimates are provided for natural gas. These include separate natural gas liquids. “Undiscovered” gas resources, as provided in the Fact Sheets, are the amount of unrelated and connected gas. The two results of the Survey are summarized in Table 1

For the 2000 assessment estimates range from 2.8 billion barrels of oil equivalent, boe, (at 95% probability) to 32.6 billion boe (at 5% probability). The 50% probability is 13.9 billion boe and the mean is 15.2 billion boe. For the 2012 assessment, estimates range from 5.2 billion boe at 95% probability and 26.0 billion boe at 5%. The 50% probability is 12.5 billion boe and the mean is 13.6 billion boe. Findings to date by ExxonMobil and partners reveal larger amounts (at 9+ billion boe) than the 95 percent probability estimate for both assessments.

Two further comments are needed at this point. First, these estimates are provided for a virgin boundary region, and as a result need to be supported by detailed petroleum geology assessments, for verification. Second, the mean natural gas estimates are for 42.1 and 21.2 billion cubic feet, respectively. And, for natural gas liquids the mean probability is 2.3 and 0.6 million barrels, respectively. The five percent probability values double those for the mean probability.

It should be kept in mind that these survey assessments were conducted as a subset of the USGS World Assessments. Further, the natural gas estimates in cubic feet and boiling natural gas liquids are reported. The standard conversion ratio of natural gas to boiling is 6,000 cubic feet of natural gas equivalent to one boe.

Further Justification

At this point, I hurry to remind readers that my bullish prediction was first presented in my Sunday Stabroek columns back in October 2016. Later, I had reaffirmed this prediction further as I elaborated the Guyana Petroleum Roadmap, and submitted over the period February 2017 to February 2019. I had revisited these issues in my contributions to the Buxton Proposal series of columns.

Collection

It is worth noting that this issue has resurfaced as “news” in local print and social media. It is becoming increasingly apparent to analysts and researchers that there is a rapid “arrival” of world-class petroleum discoveries in the Guyana-Suriname Basin. So, in March 2020, the Chairman and CEO of Exxon revealed that despite the severe global difficulties, the supermajor is facing it (given the state of the world market for raw): … At least for the next five years ”(my emphasis). Based on such commentary by the public policy group American Security Project, ASP has predicted that Exxon’s projection of 750,000 barrels of oil a day from Guyana “could be a significant underestimation” (my emphasis). The ASP asked that if everything goes smoothly in allowing oil production: “output could rise to over one million barrels a day by 2030”.

A year later, March 2021, the Vice President of Upstream announced that the Company had doubled its recoverable resources from 9 billion boe to 18 billion boe!